tax abatement definition accounting

The process is actually quite simple. Brief descriptive information that.

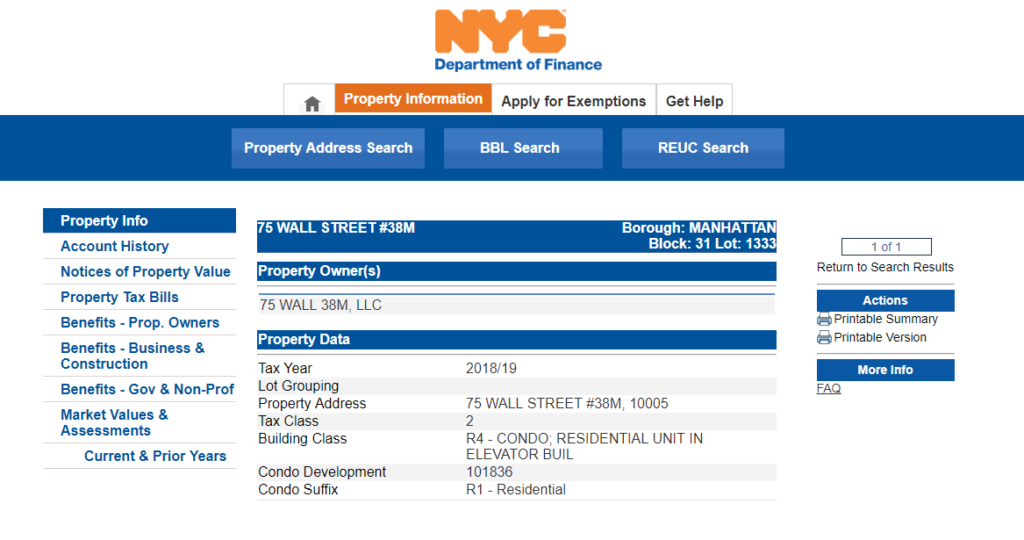

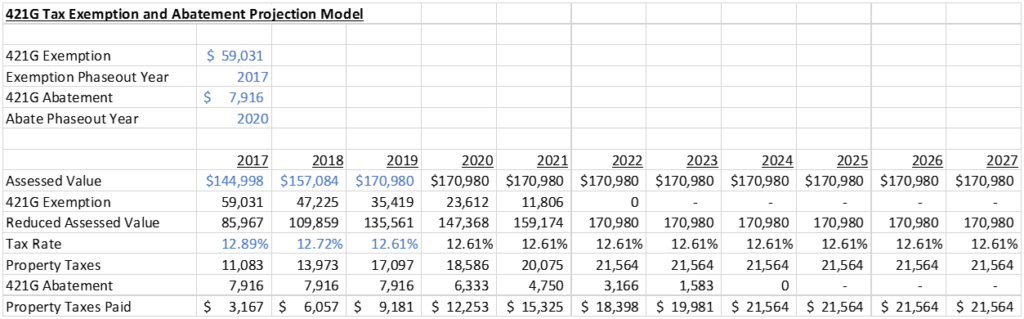

What Is The 421g Tax Abatement In Nyc Hauseit

An amount by which a tax is reduced.

. The term abatement refers to a situation where an economic burden is reduced. A taxpayer may request abatement of tax penalty and interest providing certain criteria for each are met. The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits.

Abatement can be defined as a reduction in the tax rate or tax liability that is applied to an individual or a business entity. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. A sales tax holiday is another instance of tax abatement.

A reduction of taxes for a certain period or in exchange for conducting a certain task. Instructions to preparer. Tax abatement on property is a major savings.

Whether revitalization efforts will ultimately prove successful is a big question mark. For instance local governments may offer abatements to cover the cost of building new infrastructure to incentivize development or. An abatement is a tax break offered by a state or municipality on certain types of real estate or business opportunities.

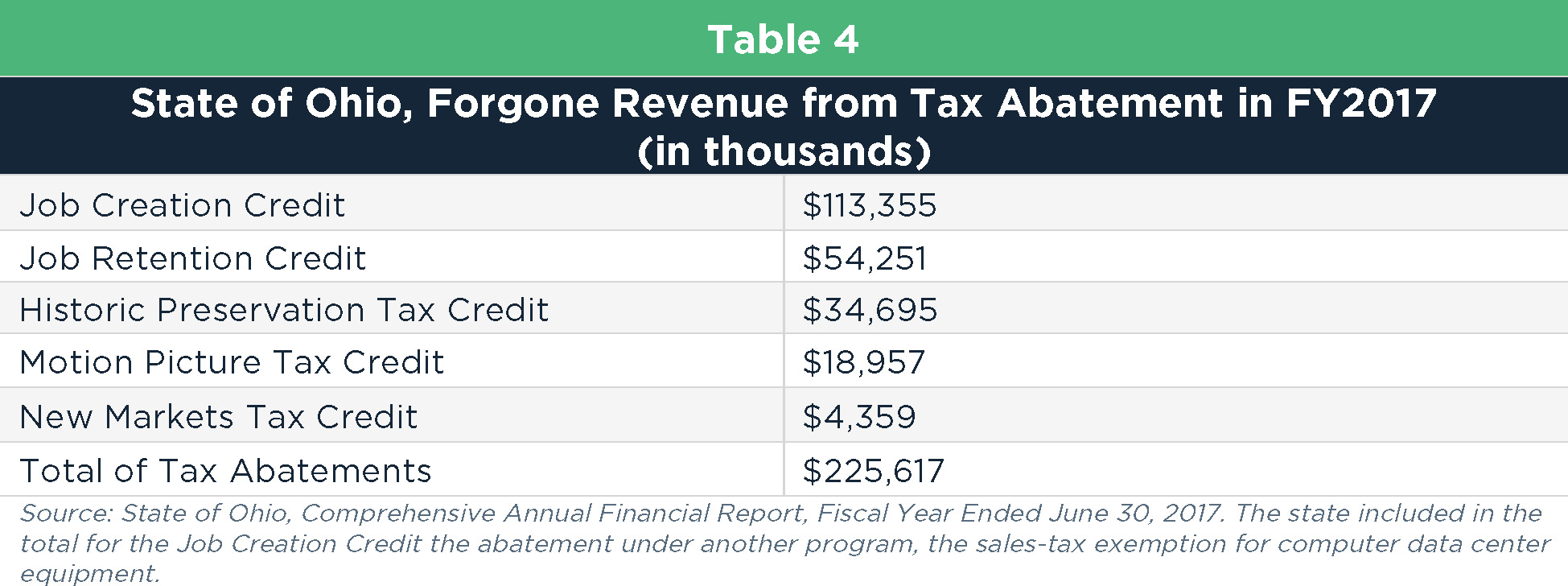

The dollar amount of tax revenues being reduced as a consequence of tax abatement agreements during the accounting period. The tax abatement is an incentive to encourage people to redevelop and move into these areas. Recently the GASB published GASB Statement No.

One or more governments. Property tax abatements are offered by some cities in the form of programs that. The development is eligible for a 10-year.

77 Tax Abatement Disclosures that will require those state and local. Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year. The abatement is usually for specific projects and.

Set the property tax amount in the direct cap proforma to market arriving at an adjusted net operating income. IRS Definition of IRS Penalty Abatement. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment.

This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. A reconsideration is when a taxpayer submits information not previously considered. Example of Abatement The major and most profound examples.

A Tax Abatement is an exemption or a reduction in taxes. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying. Calculate the present value.

Definition of tax abatement. A real estate tax abatement may reduce a homes. A reduction or decreaseLocal governments sometimes offer tax abatements to new businesses in order to attract them to the areaCommercial leases usually have clauses.

Defines a tax abatement as a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Tax abatement represents a reduction of government revenue and therefore may. In broad terms an abatement is any reduction of an individual or corporations tax liability.

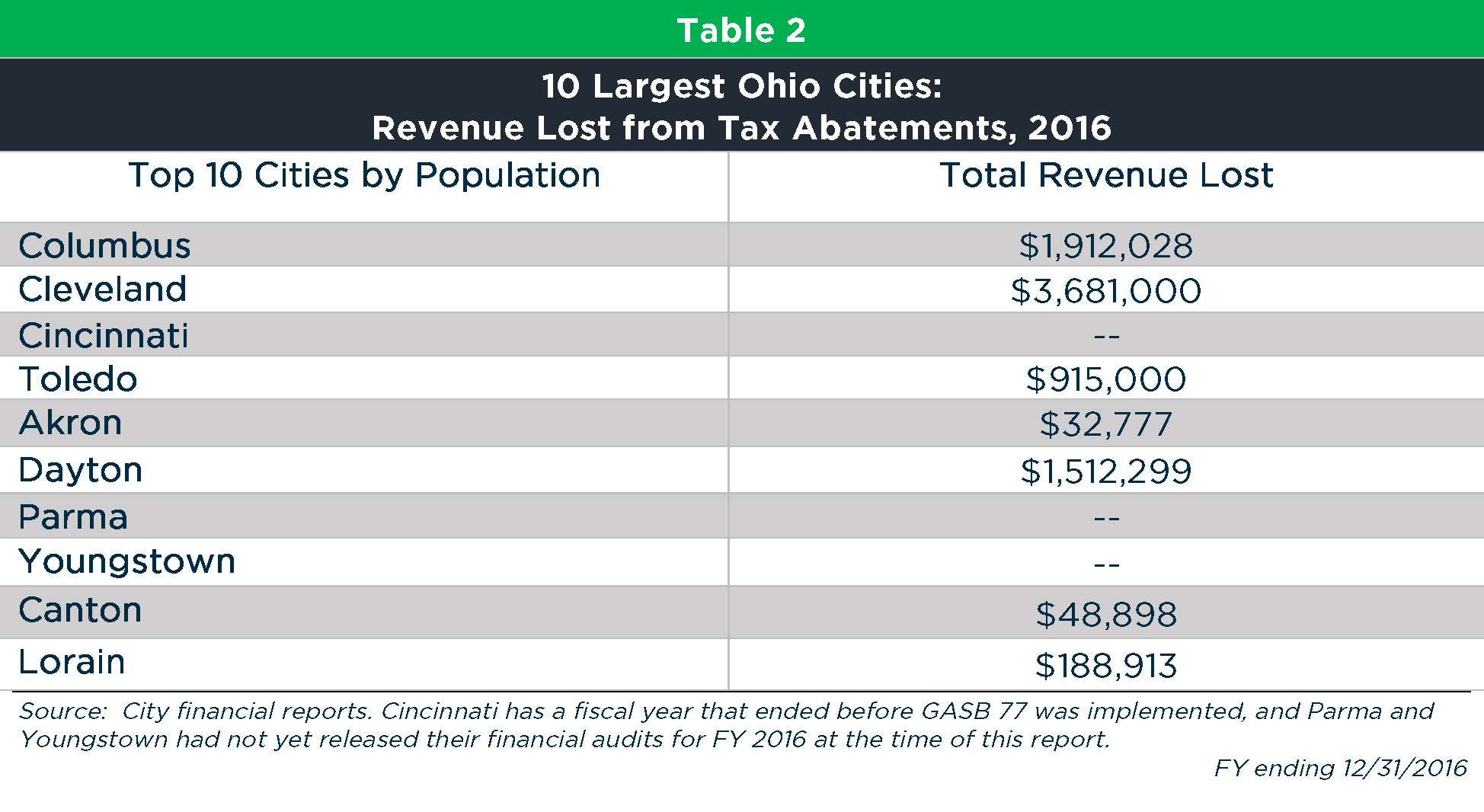

The Abatement is offered by city county state or federal governments. The Governmental Accounting Standards Board GASB Statement 77 Tax Abatement Disclosures is effective for years ended December 31 2016 and. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations.

Such arrangements are known as tax abatements. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

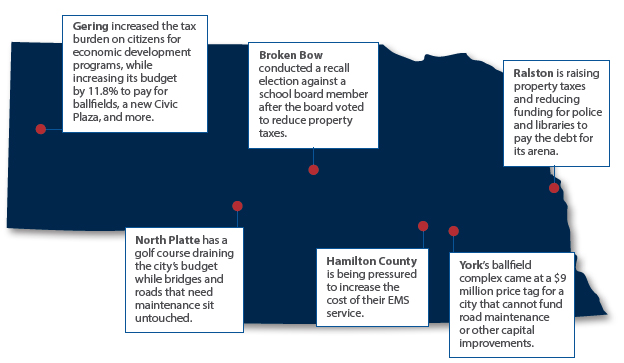

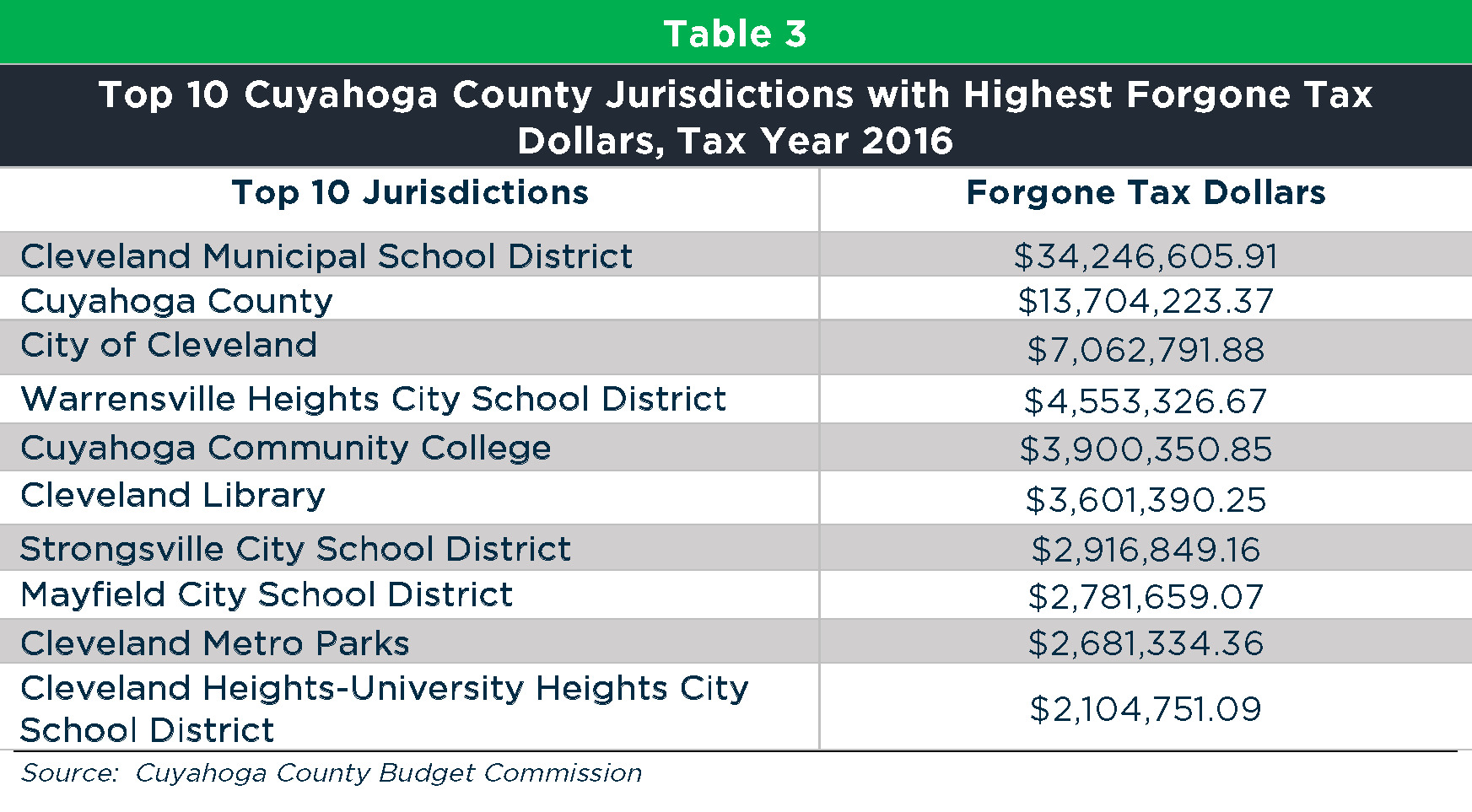

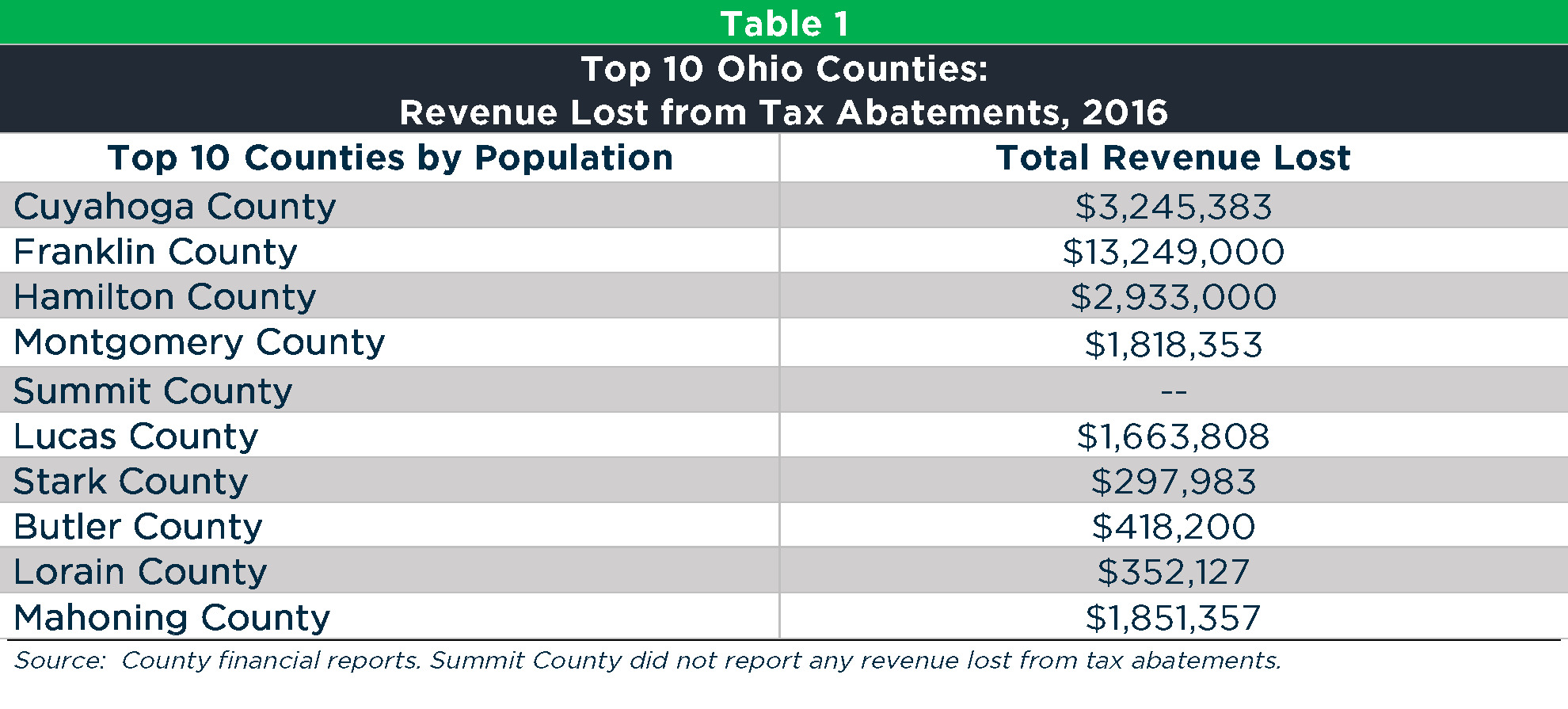

Local Tax Abatement In Ohio A Flash Of Transparency

Nyc Solar Property Tax Abatement Pta4 Explained 2022

How Much Is The Coop Condo Tax Abatement In Nyc

Tax Liability What Is A Tax Liability And What You Should Know

A Solar Powered Home Will It Pay Off Mortgage Lenders Paying Student Loans Top Mortgage Lenders

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

10 Of The Most Common Terms Of Tax Resolution Explained Five Stone Tax Advisers

Local Tax Abatement In Ohio A Flash Of Transparency

What Is A Deferred Tax Liability Community Tax

What Is The 421g Tax Abatement In Nyc Hauseit

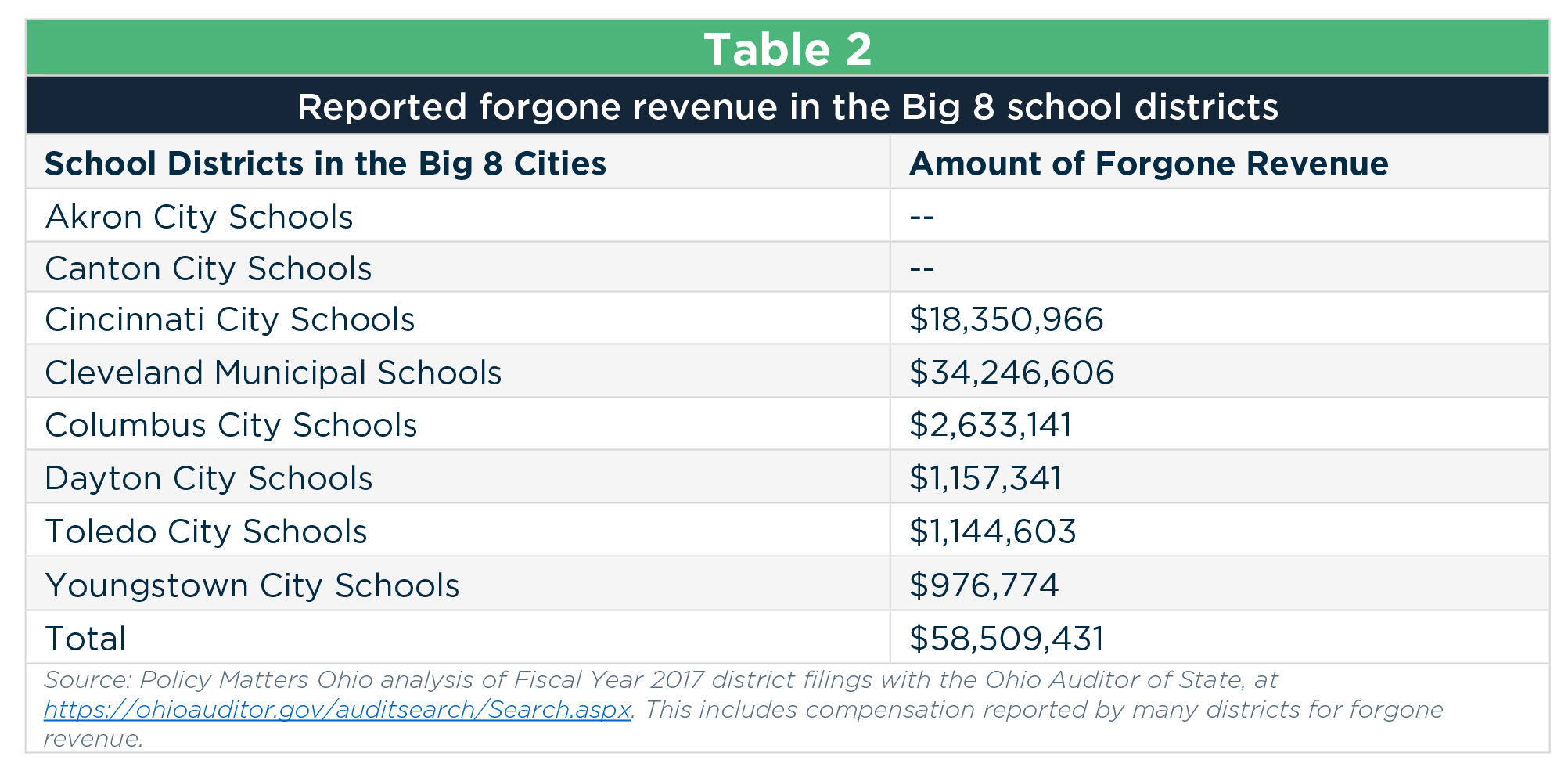

Local Tax Abatement In Ohio A Flash Of Transparency

Is Akron S Tax Abatement Program Working Here S Who Is Using It And Why The Devil Strip

Tax Abatements Cost Ohio Schools At Least 125 Million